foreign gift tax india

However if you receive gifts higher than this amount the entire gift becomes taxable. Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion.

Yes Reserve Bank Has Granted General Permission To Foreign Citizens Of Indian Origin To Acquire Or Dispose Of Properties Up To The Originals Citizen Ahmedabad

All immovable property assets like land.

. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and. The amount is added to the receivers income and taxed as per the income tax slab applicable to the receiver. But under current Income Tax rules gift taxation is a.

Foreign Gift Tax the IRS. Ad Helping Businesses Navigate Various International Tax Issues. You can gift upto USD 15000 without any tax liability annual exclusion.

Consulting and Scalable Services to Help Businesses with Foreign and International Taxes. Later in 2004 Gift tax was incorporated in the Income Tax Act. Under the now-repealed Gift Tax Act of 1958 the payment of tax on gifts earlier rested with the donor.

Gifts up to rs 50000 per annum are exempt from tax in india and gifts from relatives like parents spouse and siblings are also exempt from tax. 50000 to a Resident Indian who is a non-relative the NRI gift taxes. However in 1998 this Gift Tax was abolished.

The IRS defines a foreign gift is money or other property received by a US. There was an ambiguity on taxability of gifts received outside India. Tax on gifts - India Prior to 1998 gifts used to be taxed in the hands of the giver in the form of Gift Tax.

IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate. IRS Form 3520 is required if. Learn How EY Can Help.

NRIs are taxable on gifts received in India or accruing or arising in India or deemed to accrue or arise in India. For example if you. As a US person you are.

So if you are receiving more than Rs. The new tax is not applicable to inward. Learn How EY Can Help.

If you are a US. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes. Gifts to Resident Indians from NRIs non-relative within INR 50000- are exempt from tax for both giver and receiver.

Money received without any consideration. 1 Gifts up to Rs 50000 in a financial year are exempt from tax. Foreign gift tax india.

Ad Browse Discover Thousands of Law Book Titles for Less. Tax on gifts in India falls under the purview of the Income Tax Act as there is no specific gift tax after the Gift Tax Act 1958 was repealed in 1998. When an NRI gives gifts in the form of cash cheque items or property that exceeds the value of Rs.

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. Home - Central Board of Direct Taxes Government of India. In addition gifts from foreign corporations or partnerships are subject.

Ad Helping Businesses Navigate Various International Tax Issues. Gifts worth more than Rs. The Gift Tax was introduced in India in 1958 and got abolished in 1988 after which all gifts were tax free.

How to Declare Tax on Gifts in India. The entire amount in cash received as a gift. Gifts of foreign financial.

Unlike in India in USA Gift tax is payable by the donor ie. Above 15000 USD as gifts will trigger a tax event. The giver of the gift.

Sending Gifts To Children Relatives Abroad You May Have To Pay Tax The Financial Express

Did You Receive Gift Tax Implications On Gifts Examples Limits Rules

Tax Rules For Nris On Sale Of Assets Located In India Mint

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Residential Status For Nri Non Residence Of India Huf Firm Aops And Company For Ay 2018 19 Income Tax Income Tax Refund

Know More About Itr Form 2 At Taxraahi Taxraahi Is Your Online Tax Return Filing Companion In Delhi Gurgaon Noida An Income Tax Return Tax Return Income Tax

28 99us Lot 100 Pcs Set Different World Notes From 30 50 Countries Free Shipping Gift 100 Real Original Unc Non Currency Coins Aliexpress

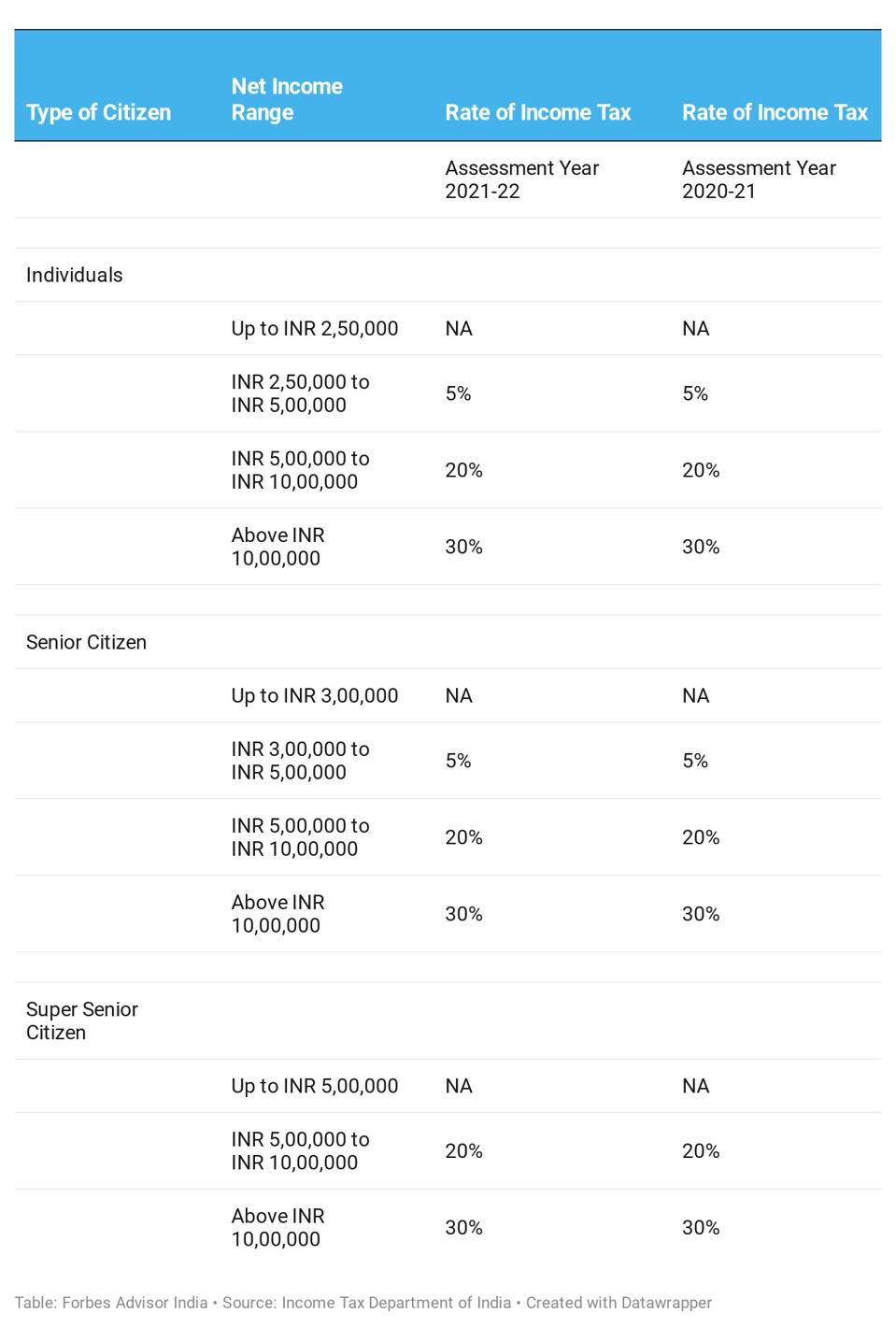

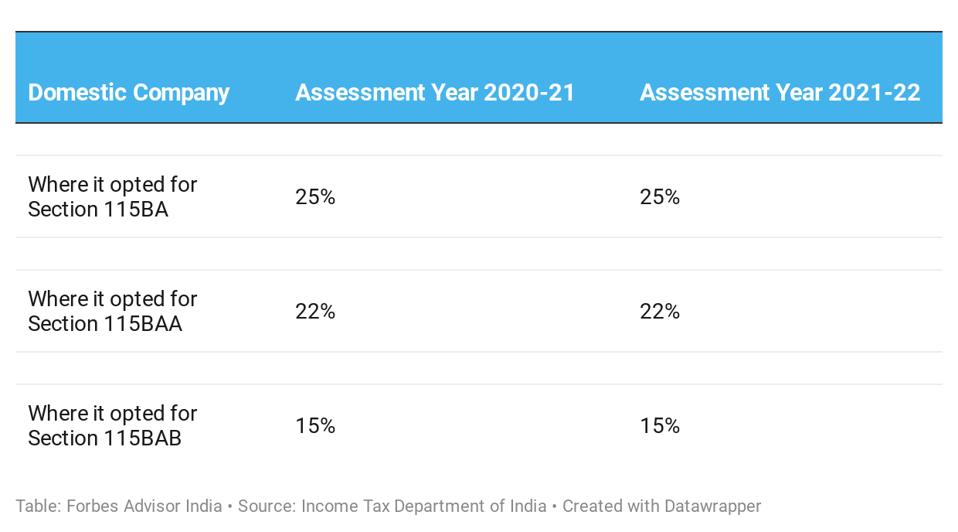

Know Types Of Direct Tax And Charges Forbes Advisor India

Tax On Gifts In India Fy 2019 20 Limits Exemptions And Rules

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

Know Types Of Direct Tax And Charges Forbes Advisor India

What Are Tax Rules For Foreign Retirement Accounts Mint

All About Msme Loans Under 59 Minutes In India Eztax In Tax Software Accounting Accounting Software

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Income Tax Efiling In India For Fy 2021 22 Ay 2022 23 Cleartax Upload Your Form 16 To E File Income Tax Returns

Selling Gifted Property In India 5 Important Things You Should Know In Filing Itr This Year Income Tax Return Income Tax Paying Taxes

Gift From Usa To India Taxation And Exemptions Sbnri

Tax Implications On Money Transferred From Abroad To India Extravelmoney